SAQA ID: 61589 (LP 20186)

National Certificate Banking NQF Level 5

Title of Qualification:

SAQA ID: 61589 (LP 20186) National Certificate: Banking NQF Level 5

Duration of Qualification:

This programme consists of Fundamental and Elective Unit Standards and will be covered over a period of one year( see breakdown for more information)

Total Number of Credits:173

Entry Requirements

Access is open to all learners bearing in mind the learning assumed to be in place.

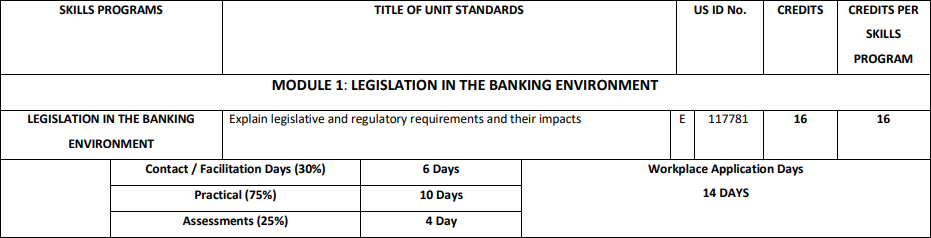

Module 1: LEGISLATION IN THE BANKING ENVIRONMENT

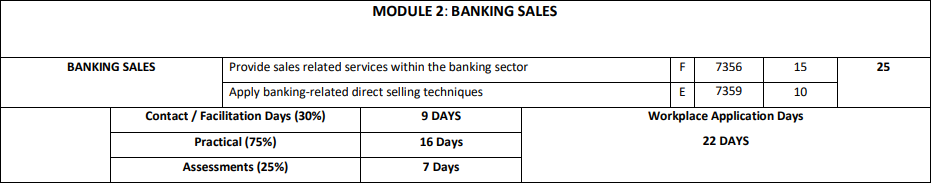

Module 2: BANKING SALES

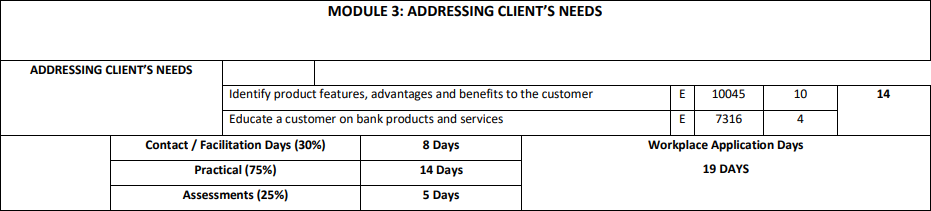

Module 3: ADDRESSING CLIENT’S NEEDS

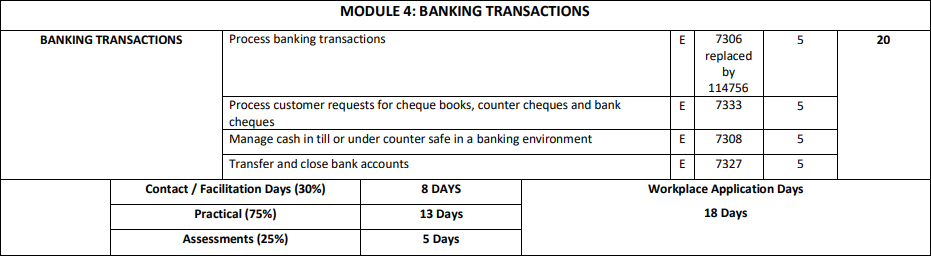

Module 4: BANKING TRANSACTIONS

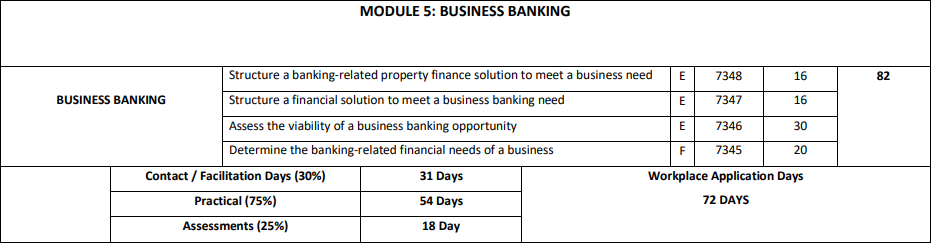

Module 5: BUSINESS BANKING

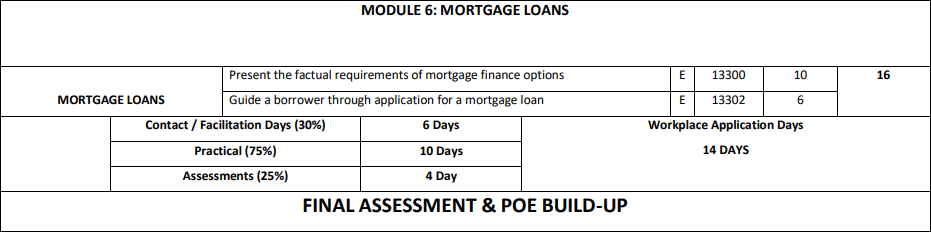

Module 6: MORTGAGE LOANS

The South African Qualifications Authority Act, 38 of 1995, states that the objectives of the National Qualifications Framework are to “… to create an integrated national framework for learning achievements; facilitate access to, and mobility and progression within education, training and career paths; enhance the quality of education and training; … accelerate the redress of past unfair discrimination in education, training and employment opportunities; and thereby … contribute to the full personal development of each learner and the social and economic development of the nation at large. The qualification is intended to reflect the entirety of skills possessed by any particular learner, regardless of that learner’s prior educational background.

In accordance with the terms of regulation 6140 and the needs and requirements of the specific banking industry the purpose of this qualification is to represent a planned combination of learning outcomes in the field of business, commerce and management studies and specifically the sub-field of banking which has the purpose to provide qualifying learners the competence and the basis for further learning. It further promotes the enhancement and marketability and employability of learners and plans to open up the access routes to additional education and training through this process.

Learning assumed to be in place and recognition of prior learning.

The qualification is specifically designed to accommodate a broad range of recognition of prior learning. This intention is reflected in the structure of the qualification and also in the rules for combination of credits towards the qualification. The intention is to provide recognition for all the relevant skills which learners already possess and even to provide recognition for skills which might not be relevant to the job through the elective category. It is recognised that these suites of skills will differ radically from learner to learner and from bank to bank. The philosophy of flexibility expressed elsewhere in this document arises from a desire not to unnecessarily deny access to an appropriate qualification to any learner.

Course Objectives

The exit-level outcomes of the qualification will be the sum of the outcomes of all the unit standards constituting the qualification. It is not possible to be more specific about the exit-level outcomes because the flexibility envisaged in the qualification makes countless permutations of unit standards possible. This flexibility is desirable because it reflects the multi-disciplinary nature of banking work, and the fluidity of jobs and roles within the banking profession.

The sum of the specific outcomes of the unit standards comprising the qualification should make the learner competent for his/her job in banking, recognizing that no prescribed combination of unit standards will make the learner competent for all jobs in banking, even at a particular level of work.

For the learner who exits the qualification before completion, the opportunity always remains to re-enter the qualification, or even to re-enter a qualification at a higher level, incorporating the applicable unit standards for which he/she already has credit. In any event, the specific and critical cross-field learning outcomes which are required for competence in terms of the qualification should be consistent with the requirements for effective performance in the job.