Short-term Insurance Level 4

Title of Qualification:

SAQA ID: 66610 Further Education and Training Certificate: Short-term Insurance Level 4

Duration of Qualification:

This programme consists of Core; Fundamental and Elective Unit Standards as follows and will be covered over a period of one year

Total Number of Credits:155

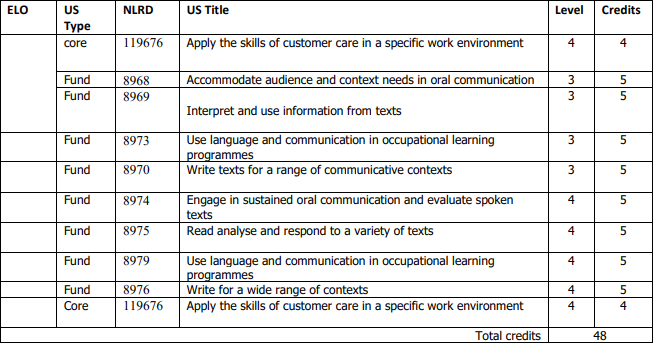

Module 1: Communication Literacy

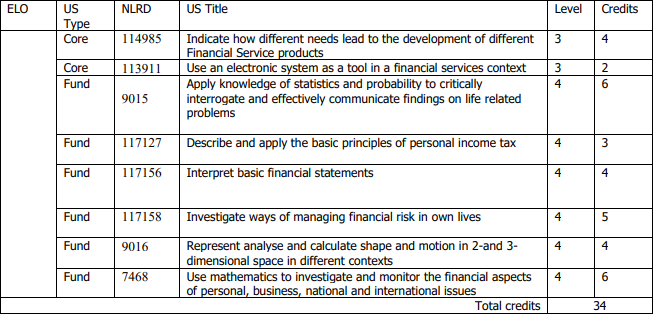

Module 2: Mathematics and Financial literacy

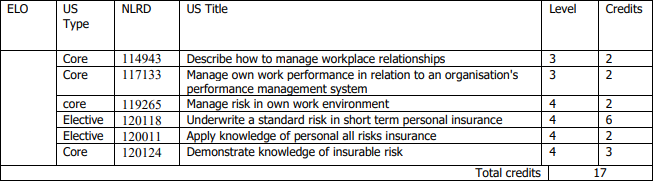

Module 3: Managing trends in the insurance industry

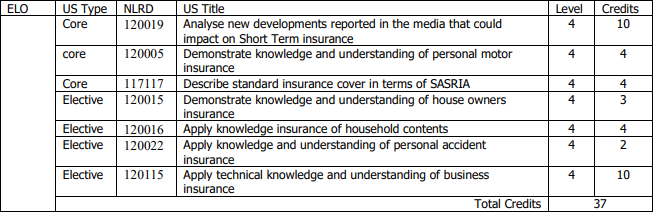

Module 4: Demonstrating knowledge of insurance related products

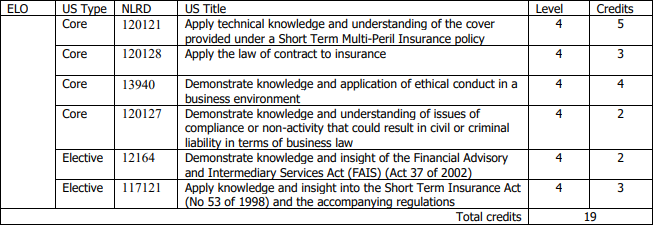

Module 5: Insurance Legislation and Compliance

The purpose of the Qualification is to build knowledge and skill required by employees in Short Term Insurance who have had schooling at or below NQF level 4. It is an entry Qualification into Short Term Insurance as learners will not have acquired the necessary knowledge and skills as part of the school curriculum. It is intended to empower learners to acquire knowledge, skills, attitudes and values required to operate confidently as individuals in the South African community and to respond to the challenges of the economic environment and changing world of work in the financial services industry. It should add value to the qualifying learner in terms of enrichment of the person, status and recognition

Who is the course intended for?

Employees in Short-Term Insurance who have had schooling at or below NQF level 4

Learning assumed to be in place and recognition of prior learning

Learners accessing this qualification are assumed to be competent in:

• Carrying out basic research, information gathering and analysis.

• Interpreting current affairs and their influence on Short Term Insurance.

• Communication and Mathematical Literacy at a level that allows them to operate effectively in the financial services industry.

• Behaviour and ethics in a work environment and the implications, consequences and liability arising out of non-compliance with relevant legislation.

• Managing aspects of personal finances.

• Knowledge of Short Term personal and/or commercial lines products.

• Customer care including internal and external customers.

• Understanding the key terms, rules, concepts and principles of the ShortTerm sub-sector, in general and their chosen career path, in particular.

• Knowledge of insurable risk and application of the law of contract in Short Term Insurance.

• Managing an information system used in Short Term Insurance.

Recognition of prior learning:

• The FETC: Short Term Insurance allows open access. Provision has been made for prior learning to be recognised if a learner is able to demonstrate competence in the knowledge, skills, values, and attitudes implicit in this Qualification. Application for Recognition of Prior Learning (RPL) should be made to a relevant accredited

ETQA.

• Credit towards a Unit Standard is subject to quality assurance by a relevant accredited ETQA and is conducted by a workplace assessor.

• This Qualification can be obtained in part or in whole through Recognition of Prior Learning.

• RPL will be done using a range of assessment tools and techniques that have been jointly decided upon by the learner and the assessor.

• The same principles that apply to assessment of the Qualification and its associated Unit Standards apply to RPL.

On achieving this qualification, the learner will be able to:

Learners should have the capacity to take responsibility for their own learning within a supervised environment and should be able to evaluate their own performance and address their shortcomings.

The Exit Level Outcomes and their Associated Assessment Criteria are the following, which means that the learner will be capable of:

1. Carrying out basic research tasks and applying literacy and numeracy skills to analyse, interpret and evaluate information from a range of sources related to Short Term Insurance or reInsurance.

2. Managing personal finances.

3. Apply knowledge of legislation, ethics, compliance and organisational protocols in the Short-Term Insurance environment.

4. Manage own work situation and interpersonal interactions